To the shock of absolutely no one, Gartner, Inc. is reporting that global PC shipments decreased for an 11th straight quarter.

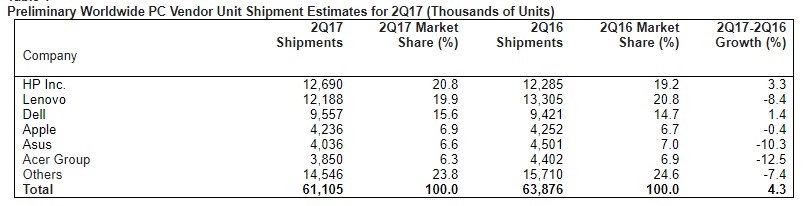

Worldwide shipments totaled 61.1 million units in Q2 2017, the lowest quarter volume since 2007. This marks a 4.3 per cent decline year-over-year. According to Gartner, higher PC prices due to a shortage of various components had a negative impact on this second quarter decline.

“Higher PC prices due to the impact of component shortages for DRAM, solid state drives (SSDs), and LCD panels had a pronounced negative impact on PC demand in the second quarter of 2017,” said Mikako Kitagawa, principal analyst at Gartner in a statement. “The approach to higher component costs varied by vendor. Some decided to absorb the component price hike without raising the final price of their devices, while other vendors transferred the costs to the end-user price.”

This didn’t lead to a universal decrease in shipments for every PC vendor. Both HP Inc. and Dell reported growth in Q2 2017 year-over-year, at 3.3 per cent and 1.4 per cent respectively. This is the fifth consecutive quarter of year-over-year growth for HP, who has now overtaken Lenovo in the worldwide PC market. Gartner attributes this towards the company exceeding the regional average in the U.S. market.

Dell also saw growth for the fifth consecutive quarter year-over-year. This can be attributed towards it’s priority on PCs-as-a-Service. Of the top 3 PC vendors, Dell is the only one who can also supply integrated IT due to the entire Dell EMC umbrella.

Lenovo, on the other hand, saw its shipments decline by 8.4 per cent this quarter after two quarters of growth. It reported shipment declines in all key regions. Kitagawa said that this could ‘reflect Lenovo’s strategic shift from unit share gaints to margin protection’.

“In the business segment, vendors could not increase the the price too quickly, especially in large enterprises where the price is typically locked in based on the contract, which over run through the quarter or even the year,” said Kitagawa about how vendors can tackle the rise in component prices.

“In the consumer market, the price hike has a greater impact as buying habits are more sensitive to price increases. Many consumers are willing to pospone their purchases until the price pressure eases,” she said. ‘

It should be noted that these numbers are based on desk-based PCs, notebook PCs, and ultramobile premiums such as the Microsoft Surface Pro. Chromebooks and tablets are an entirely different story and not included.

Although it should be mentioned that Chromebook shipments aren’t completely unrelated to PC shipments. In 2016, worldwide Chromebook shipments rose by 38 per cent while the overall PC market declined by six per cent.