-

The history of the tech industry is littered with the corpses of failed mergers that have brought once-mighty companies to the brink of disaster. But despite the fact that roughly seven out of 10 mergers are failures, tech companies are still going out of their way to acquire one another. Recent examples of big-time mergers include the proposed AT&T-T-Mobile deal and Microsoft’s acquisition of Skype. In this slideshow, we’ll take a look at seven proposed mergers that we hope will never see the light of day, as their consummation would likely mean the end of the entire tech industry and possibly even the entire world.By Brad Reed

-

Windows-Android

Imagine what would happen if Microsoft and Google decided to take the worst features of their mobile operating systems and combine them into an unruly behemoth known as “Windroid.” In other words, you get Microsoft’s standard proprietary rent-seeking combined with Google’s borderline anarchistic approach to selling mobile applications. Or put another way, have a good time paying more money for applications that will be more likely to infect your phone with malware.

-

Apple-Adobe

Apple’s feud with Adobe’s Flash is well-documented. Basically, former Apple CEO Steve Jobs has claimed that Flash is a poorly designed program responsible for crashing Apple computers. Jobs has also said Flash is ill-equipped for mobile devices as it sucks up battery life and has security holes. The problem for Apple, however, is that Flash is still the most commonly-used protocol for delivering video over the Web. The best solution, then, would be for Apple to simply buy Adobe and liquidate Flash all together. Bada-bing, bada-boom, problem solved!

-

Verizon-AT&T

If the AT&T-T-Mobile merger gets approved, then Verizon and AT&T will account for around 80% of all wireless subscriptions in the U.S., thus creating a near-duopoly in the wireless telecom industry. But heck, if we’ve gone this far, why not just have AT&T and Verizon get together and then hand them all of the wireless spectrum in the U.S. And since any attempt to regulate this newly-formed monstrosity would be denounced as communism, that means AT&T-Verizon would have total control over all of our wireless communications! What could possibly go wrong?

-

AOL-Friendster

Things haven’t gone well for AOL lately, as the company has been hampered by little issues such as having a crappy service that no one wants to use. The good news is its brain trust has finally figured out a way back to the big-time: Y’see, apparently the kids these days are into this thing called “social net-working.” So to stay on the cutting edge, AOL will decide to acquire Friendster, which everyone knows is the hippest social net-working website on the InterWebs. Analysts estimate that once the companies have merged they will have at least a dozen combined users.

-

McAfee-Rovio Mobile

Fighting viruses on your PC gets old after a while. You perform an hour-long scan of your drive, quarantine suspicious files, scrutinize them and then delete them one-by-one. To rectify this, imagine what would happen if McAfee tried to spice things up a bit by overlaying Rovio’s uber-popular “Angry Birds” interface onto its antivirus software. Suspected viruses appear on your screen as green pigs that you then have the option of eradicating with a wide arsenal of antivirus birds. Now if only someone could figure out a way to integrate “Farmville” into hard drive reformatting.

-

WikiLeaks-CIA.gov

At this point, there’s pretty much nothing the United States government can do to stop WikiLeaks from acquiring and publishing vital state secrets. So in order to streamline the leaking process and to raise some cash to pay down the national debt, the government might consider licensing the CIA.gov domain name to WikiLeaks so the website can have easy access to U.S. intelligence databases.

-

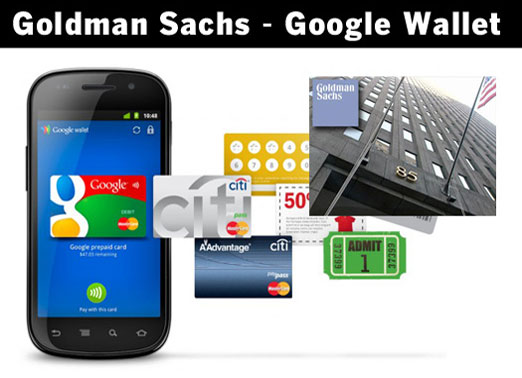

Goldman Sachs-Google (GS) Wallet

Goldman Sachs, the oft-subpoenaed investment banking titan, has done a bang-up job making money for a wide range of esteemed clients including the Greek government and Col. Moammar Gadhafi. So with this in mind, why wouldn’t you want Goldman managing your digital wallet? Just think of the joys you’ll feel when you wake up to learn that all the money in your checking account has been invested in complex currency swaps and synthetic junk bonds!

❮ ❯